While dividends represent one of the most passive income streams you can have, you also have to realize it increases your taxable income. This is of course assuming you are investing in a non-retirement account, also called a taxable account, and will receive a tax form indicating the income. In a retirement account, you only pay ordinary income tax on your qualified withdrawal of pre-tax money regardless if it’s your contribution, capital gains, or dividends. Dividends come in different flavors: Qualified dividends and ordinary dividends.

Qualified Dividends

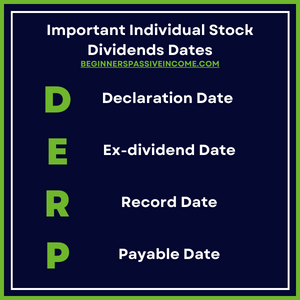

In the US, both domestic and foreign corporations can meet certain requirements that allow their dividends to receive long-term capital gains tax treatment compared to other companies. This is done to incentivize companies to pay higher dividends. To ensure your dividends receive this tax treatment, first check to see if the company is specifically excluded by the IRS. Then, make sure you buy shares 60 days before the ex-dividend date. Individual stock dividends have 4 important dates often referred to by the acronym: DERP

Declaration Date: Board of directors announce dividend

Ex-dividend Date: If you buy shares ON or AFTER this date, you are excluded from receiving a dividend

Record Date: Set by the company to look at who are the shareholders to receive the dividend

Payable Date: This is the date it will be paid to your account.

Just like with the long-term capital gains accompanying a selloff of shares, you as the investor are incentivized to hold on to these stocks for the long run so you can receive more tax efficient income.

Ordinary Dividends

For starters, there is nothing “bad” about ordinary dividends. Any money you can make without having to go to a job or sell something is a huge win! Ordinary dividends just means it will be taxed at your ordinary income tax. However, that also means if you are close to reaching a new tax bracket, this income could push you into the next tier. Outside of that, they are acquired the same way as qualified dividends following the DERP calendar but you don’t have to worry about buying 60 days in advance. As long as you buy before the ex-dividend date, you’ll get the dividend.

How does this affect my passive income portfolio?

After you’ve determined that you want to start receiving dividends, you may begin to consider where to hold dividend paying investments. If you hold them in a taxable account…you’ll get taxed. If you hold them in a pre-tax retirement account (IRA), you’ll delay paying ordinary income tax until you withdraw it later in life. While there’s no harm in holding companies that pay qualified dividends in a retirement account, you’re just not taking advantage of the tax incentive handed out by the IRS. Many seasoned investors will strategically put assets that would increase their income tax liability in IRAs and put assets that have reduced tax liability in taxable accounts for hopefully obvious reasons.

Here’s a list of dividend bearing assets:

Stock Ownership (Public or Private): Whether you hold shares of a public company or own a percentage of a private corporation, as an owner you are entitled to declared dividends. It is possible to receive qualified or ordinary dividends depending on the corporation.

Mutual Funds: Interestingly, depending on what assets are held, it’s possible to have 100%, 1-99%, or even 0% of the dividends to be considered qualified dividends. The fund should have documentation of how it’s dividend has been taxed in the past and you’ll also get a break out on your tax form. Funds can also randomly send you short-term capital gains which are also taxed at ordinary income along with any ordinary dividends. While mutual funds can be great for diversification purposes, be considerate of which account you hold the fund in and your potential tax liability.

Public REITs: Remember there are multiple kinds of REITs. Some are traded on a stock exchange and others are not. Either way, these companies are currently not eligible to receive qualified dividend treatment. While they are great for income, just know it will be taxed at ordinary income.

Private Investments: More often than not, these investments are structured as partnerships and LLCs. The IRS states that in order to distribute qualified dividends, the entity must be a domestic or qualified foreign corporation. However, to make up for the potential inability to offer capital gains tax treatment on their dividends, these investments frequently allow losses to be passed on to the investors. This means you may not pay taxes at all on the dividends you receive if your losses outweigh your income! Then, once the final payout occurs, you may receive a long-term capital gain distribution which are already receiving preferred tax treatment. While not a crime to hold these investments in a pre-tax retirement account, you’ll give up potentially better tax incentives than typical dividend bearing investments can offer.

Tax treatment should not be the only reason you invest in a dividend bearing asset. Due-diligence should uncover more reasons to invest such as potential growth, ability to withstand economic volatility and competitors, etc. After you’ve decided on an investment opportunity and your time horizon for needing the income or gains, how it is taxed should be used to consider which account has the highest tax advantage for you. Like we always say, it’s not about how much can you make, it’s about how much you can keep!