People usually lend money to friends interest-free, but did you know that you can provide loans just like a bank through peer-to-peer lending platforms? You can lend money to strangers with interest and make passive income from it.

Can you make money passively through peer-to-peer lending? You can make passive income through peer-to-peer lending platforms offering this service. The process is simple, the peer-to-peer platform acts as an intermediary between yourself and the person in need, and provides you interest in return.

Peer-to-peer lending cuts out the need for a Bank as in intermediary (although some banks have a hold in some of these platforms – source). It does not demand much work and can be profitable depending on how much money is lent and the interest rate on the loan. Joseph Hogue says he is making 10% returns on his investments. Peer-to-peer (P2P) lending platforms have their advantages, and disadvantages.

Making Passive Income with Peer-to-Peer Lending

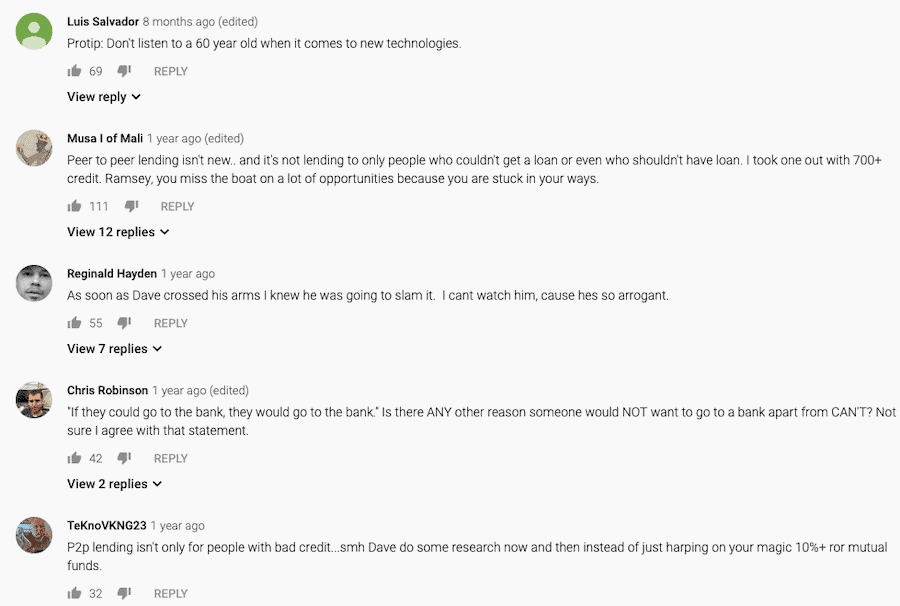

Before we dive in, we just want to say that the opinions on this passive income idea are extremely divided. Just watch the video below and have a look at the comments.

Peer to peer lending is very simple, and yet, it is also very complex. There are some things to watch out for and we will talk about some of them in this article. However, each platform is different. As usual, this guide is just for informational purposes only, so consult a certified financial planner, tax specialist or lawyer in your area if you would like advice.

1. What is Peer to Peer Lending?

In this video, Nate O’Brien clearly explains peer-to-peer lending in detail. The process is simple, the peer-to-peer platform acts as an intermediary between yourself and the person in need, and provides you interest in return without the need for a bank.

The two most popular platforms for this are LendingClub and Prosper. They have existed for over 10 years now. They allow you to loan money to a number of lenders on the platform, and you can automate the entire process by pre-selecting your criteria. The platform will then automatically match you with lenders that match the criteria you selected.

The loan borrowers are graded from A to E (from best to worst). From these, you get to choose the kinds of borrowers you want in your portfolio. You should know that the less risky the borrower, the lower the interest rate you will get from the loan you give them. Other things to note is that you should try to spread out your investments over several loans. That lowers the risk of lending out a huge chunk of your money to one person who could default.

2. How to Get Started Peer-to-Peer Lending

You will have to set up some things before you can become a P2P lender. You will also have to provide some personal financial information about yourself to be approved to register as a lender on any P2P lending sites. You should also create your lending plan which we talk about in part 3.

Fortunately, today, you have quite a couple of lending platforms to choose from. Examples include Lending Club and Prosper.com. Some platforms offer a more automated means of making money off your investment, and these should be a top priority since the goal here is to create a passive income.

But what sets one platform apart from others is usually the minimum credit score required to attain membership and the cost of fees. Some platforms let in borrowers with credit scores of just 520, while others require borrowers to have a score of at least 660 before they can join and apply for loans. In case you didn’t know, a credit score of between 300 and 579 is considered poor, while a score of between 580 and 669 is considered fair.

3. Create Your Lending Plan

You have to decide what kind of lender you will be. For instance, if you want higher interest rates, lend your money to riskier individuals. Similarly, decide in what proportions you would like to spread out your money among various kinds of borrowers. For instance, you can decide that a third of your money will go towards high-risk borrowers, while the other third will be spent on low risk borrowers. You can then set aside the other third for medium-risk borrowers. Joseph Hogue explains how he automated his settings to get 10% returns on his investments in the video below.

Once you have figured out what platform to use, the kind of loans to give, and the amount of money to invest, you can make a deposit and get started. Luckily, this is one of the few businesses where you don’t have to advertise your services. The borrowers will come looking for you.

Many people are getting into the P2P lending business, and there is still a lot of demand for the services these operations offer. Even more interesting is the fact that you can grow your investment over time very passively. Obviously, you can make adjustments to your lending criteria as time goes by based on what you learn about the market you are serving.

4. What Risks Are Involved With P2P Lending?

There obviously are many risks involved in the P2P lending business. For instance, the borrower may never pay you back. And there are many reasons for this including lack of means due to illness, loss of income, and other issues. You probably won’t be able to take any action in that case (watch the video below for more details). You should also be attentive to fees on these platforms and default rates. Make sure to read the policies before choosing a P2P platform.

Be aware that you are also investing your money for a certain amount of time and may experience a lack of liquidity, so be attentive to their investment duration (3 to 5 years). You should also be aware if the platform actually runs any background checks on the borrower by reading their terms and policies, as some platforms rely on what the borrower specifies, not any verified income. Learn more in Gram Stephan’s video below.

The platforms also have specific requirements with regards to your income to be able to apply. You may also be taking on debt that banks have deemed too risky to take on, since the borrower is not requesting their loan from a traditional source. And who knows what would happen to your money if one of these companies were to shut down.

Each country or state has particular laws regarding P2P lending ventures. For instance, there are places where you might not even be allowed to get into this business. In other places, there are very clear laws outlining how you should get into this business if that is your intention. Taxes are also important to consider. You should therefore talk to a qualified lawyer and tax specialist in your area before getting started to be sure of what you are getting into.

How Passive is Peer to Peer Lending?

Given that you can set most platforms to manage your portfolio automatically once you choose your lending settings, this is a very passive way to earn some money on the side. By venturing into this business, you will not have to change anything about your current work or social life to lend money and turn a profit.

Scalability

The lending business is very scalable, and no extra effort is needed when you decide to take things to the next level. And your scalability will depend on how much money you are willing to lend out.

Startup Costs

You can start making money passively through P2P lending with minimal investment. For instance, you can get started with as little as $25, but you can also invest ten of thousands of dollars as well if you have the money to spare.

Difficulty

Few things are easier than lending loans using a P2P lending platform. As long as you have the cash to get started, you are good to go and there are enough tutorials online to help a beginner get started quickly and easily.

Time

Hands down, this is one of the most passive income methods you could ever try. You will need just a couple hours to setup your account initially and make sure it is running the way you want. That time is negligible considering the return on investment.

Risk

This is risky business. Head back up to section 4 to read a more detailed list of risks, but they include your losing all the money you invested, lenders defaulting, making less returns due to paying fees and taxes, having your money locked in the platform for 3 to 5 years and so on.

Seasonality

Luckily, the P2P lending business is not affected by seasons, as some other ventures are. People need money all the time, whether or not it is during the holidays. That means you can expect a steady income off your investment throughout the year. As long as you have the money to lend out, you will usually have people who could use that money and repay it back afterwards.

Return on Investment

The ROI you get on your investments when you get into P2P lending can be quite good. In fact, you can get better returns than some other mainstream investments. With a large enough investment, you can easily make hundreds of dollars every month, which is not bad at all. How much you make depends on how much you lend, fees, your default rate and your tax bracket.

Related Questions

How safe is peer-to-peer lending? Done right, peer-to-peer lending is pretty safe. But as with any other business, there are risks involved. They include losing all the money you invested, lenders defaulting, making less returns due to paying fees and taxes, having your money locked in the platform for 3 to 5 years and so on.

Is peer-to-peer lending legal? P2P lending is legal in many states. Fortunately, in many places, you can legally engage in a peer-to-peer lending business. Just be sure to check what your local laws to say about your getting into this business before you get started to avoid any problems with the authorities.